If you will be maturing your pension soon, unless you purchase an annuity, it is likely that most of your fund will remain invested in the market post retirement. An important concept which every retiree should be aware of is sequencing risk.

When investing there are likely to be years when markets increase, and years when they decrease. The order and timing of good years and bad years can affect how much income you will have in retirement and how long your fund will last. The reason that the sequence matters is because in retirement you are taking an income from the fund. Taking an income in bad years crystallises losses.

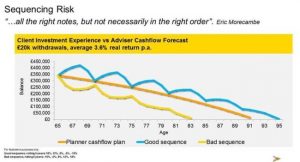

Consider the above graph which shows the journey of two post retirement investors. The good sequence (blue line) achieved returns of 18%, 12%, 8%, -5% and -15% or an average of 3.6% each year.

The bad sequence (yellow line) achieved returns of -15%, -5%, 8%,12% and 18%, the same average of 3.6% each year.

Both investors achieved the same average return but the pension fund represented by the blue line (where the bad years came later) provided an income for the investor until he reached age 95 whereas the fund represented by the yellow line (where the bad years were in the earlier stages) ran out of money when the investor reached age 83.

Having an appropriate investment and withdrawal strategy can reduce sequencing risk and help you to sustain your retirement income into the future.

If you would like to discuss planning for your retirement, please give us a call on 01 546 1100, send us your details via our Contact Us form or book a 15 minute video call with us here.

The material and information contained on this website is for general information purposes only. Neither the writer nor Highfield Financial Planning Ltd makes any warranty as to the completeness, accuracy or reliability of the information or the suitability or availability of products or services, referred to on the website, for any purpose. You should not rely on any information contained on this website as a basis for making any financial, legal, taxation or other decision. The information presented does not include all the considerations which are relevant to the topic discussed as to do so would render it un-readable. When considering any financial issue you should seek the advice of a suitably qualified adviser.

The above returns are used for the purpose of illustration only and are not typical investment returns.

Warning: If you invest in this product you may lose some or all of the money you invest.

Warning: The value of your investment may go down as well as up. You may get back less than you invest.

Warning: This product may be affected by changes in currency exchange rates.

Warning: The income you get from this investment may go down as well as up.

© Eoghan Gavigan 22 June 2021